The World Finance 100 highlights the individuals and businesses that view international connections as opportunities rather than challenges, delivering vital contributions to the global economy in the process

It’s been an uneven year for the global financial system. While some developed economies continued their upward momentum in 2018, monetary tightening had unintended negative impacts on emerging markets, with inflation wreaking havoc on businesses and investors.

Fortunately, there was plenty of good news as well: Greece exited its third and final eurozone bailout programme in August, and employment figures held strong across much of the developed world. In some markets, long-promised wage increases even began to appear. As a result, global growth, while hardly spectacular, is forecast to continue in 2019.

The past 12 months haven’t been easy for the corporate world – geopolitical issues and disruptive technologies have ensured business leaders had plenty to contend with – but they haven’t proved to be a barrier to success, either. The organisations recognised in the World Finance 100 have undoubtedly made the most of 2018, demonstrating leadership, financial discipline and creativity to move to the top of their respective fields in difficult circumstances.

Joining the dots

The global economy is more connected than ever. International supply chains allow companies to expand into new areas by seeking out talented staff and affordable production costs. But as the 2008 financial crisis showed, globalisation also has its drawbacks; when things start to go badly, contagions can spread very quickly.

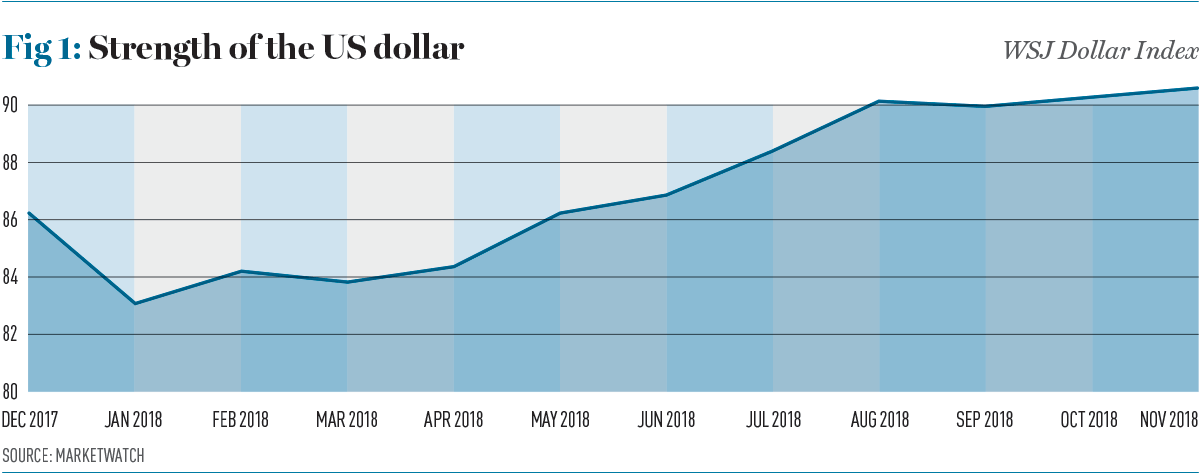

In 2018, the global economy presented another challenge: the strong US dollar. Driven by deregulation, tax cuts, increased spending and rising interest rates, the US economy grew impressively throughout the year. Unfortunately, what’s good for one part of the world is not necessarily good for another: many emerging markets hold large quantities of dollar-denominated debt, which meant the surging greenback (see Fig 1) created concerns over repayments last year. As a result, many investors decided to move their money to the US, prompting inflation in the emerging economies they left behind.

Fears of an all-out trade war only exacerbated currency depreciation: between January and August, for example, the Turkish lira fell by more than 40 percent against the US dollar. Other currencies, including the South African rand and the Indian rupee, experienced similar – albeit less pronounced – falls.

However, these emerging market difficulties cannot all be blamed on the US, nor can they all be attributed to President Trump. In Zambia – where the declining kwacha has raised fears of default – rising oil prices have certainly played their part. In Argentina, policy errors left President Mauricio Macri needing one of the biggest bailouts in IMF history, while Recep Tayyip Erdoğan’s mistrust of interest rates – the Turkish president referred to them as the “mother and father of all evil” back in May – has limited his country’s response to the inflation crisis.

It should also be noted that the picture among emerging markets is far from uniform. While 2018 created losers, there were a number of winners too, including investors in debt markets in Iraq and Mongolia. In spite of this uncertain landscape, one thing remains clear: investors must carefully consider the level of integration at the heart of the global economy. A political decision made in Washington DC can have ramifications in far-flung markets.

Slow going

Even moving away from the turmoil witnessed in some emerging markets, global growth – the US aside – has been disappointing over the past 12 months. In Q3 2018, economic growth in the eurozone was measured at just 0.2 percent – its lowest level for four years.

In France, President Emmanuel Macron’s attempts to reform the economy have faced stern resistance and seen his popularity ratings plummet. In 2019, his country’s debt level is expected to reach 98.6 percent of GDP. Elsewhere, the uncertainty caused by Brexit continues to make for a difficult investment climate in the UK, and Germany proved it was not immune to Europe’s woes when manufacturing growth in the country slowed to a 29-month low towards the end of 2018, with new factory orders falling for the first time since November 2014.

“Although it would be hyperbolic to claim the world economy is in disarray, there are clearly some causes for concern”The flashpoint, however, is likely to arise in Italy. The government wants to increase spending in an effort to improve the country’s sluggish growth, but is being rebuffed by the European Commission. The back and forth between Rome and Brussels has renewed fears of a eurozone crisis.

The outlook in China – long the world’s growth engine – also diminished in 2018. Trade tensions with the US and falling domestic consumption brought expansion to its slowest rate since the financial crisis. Even the US’ growth rate is unlikely to be sustained in the long term. With all this in mind, the IMF has revised its global growth prospects for 2019, down 0.2 percentage points from its earlier forecast.

Although it would be hyperbolic to claim the world economy is in disarray, there are clearly some causes for concern. Businesses worried about an uncertain future should begin making strategic investments immediately, if they have not done so already. Digital technologies – including cloud computing, 5G networks, machine learning and blockchain – must be embraced if businesses are to ensure they’re not outmanoeuvred by their competitors. In the event of a slowdown, it will be the most agile and efficient companies that survive the economic disruption.

Something old, something new

The banking sector has provided a stark reminder of what can happen when organisations stand still. For decades, the huge financial capital required to enter the market, combined with tight regulation, protected banks from competition. Today, however, the loosening of industry restrictions has created a fertile environment in which neobanks (sometimes known as challenger banks) can emerge and compete.

Neobanks are making the most of this opportunity, providing customers with streamlined, digital-only services. One of the best known, Germany’s N26, has attracted more than one million customers since its launch in 2013. Another, Fidor Bank, offers its services in more than 40 markets. By eschewing physical branches, neobanks have been able to pass savings onto customers through highly competitive rates.

This, coupled with a straightforward sign-up process, has allowed start-ups to challenge the industry’s titans. Too many members of the old guard, it seems, have taken their market share for granted, allowing themselves to become bogged down with creaking legacy architecture and stifling bureaucracy.

Established financial firms will not simply move aside and let these new players take over, though. Already, many banks are adopting agile technologies to compete on a more even playing field with neobanks. Traditional banks also remain far more profitable than their new rivals. Ultimately, a situation could arise that sees neobanks collaborating with traditional banks, not competing against them.

Throughout 2018, many sectors around the world faced disruption. The World Finance 100 celebrates those organisations that have successfully navigated, embraced and led change within their own industries, delivering better products and services as a result.

Congratulations to all those that made the final list.